Why Your $500K Davie Practice Needs an S Corp (and When it Doesn't)

GD

If your professional practice or service business in Davie, Florida—such as a specialized medical clinic, high-end law firm, or successful marine services company—is generating a net profit of $500,000, your entity structure is now a multi-thousand-dollar decision.

At this profit level, operating as an LLC taxed as a Sole Proprietorship (Schedule C) is fiscally irresponsible. You are unnecessarily handing a massive check to the IRS every year in the form of Self-Employment (SE) Tax.

At Benefique Tax & Accounting, we guide high-touch, high-profit clients in Broward County to the right structure. For most operating businesses, the solution is converting your Limited Liability Company (LLC) into an LLC electing to be taxed as an S Corporation (S Corp). This move is foundational to reducing your SE tax burden, which hits hard in tax-friendly Florida.

The $100,000 Threshold: Why the S Corp is a Must-Do

The primary tax benefit of the S Corp is reducing the income subject to the 15.3% SE Tax (Social Security and Medicare). While an S Corp requires greater compliance and professional accounting support, the tax savings at high-profit levels easily justify this investment.

Our threshold for recommending the S Corp move is a consistent net profit of just $100,000. Above this level, the tax savings instantly and significantly outweigh the cost of professional maintenance and compliance. At a $500,000 profit, the savings are substantial and critical to advanced wealth strategy.

The Non-Negotiable Reality of SE Tax

As a default LLC/Sole Proprietor, your entire $500,000 profit is subject to SE Tax, with a blended rate:

- 15.3% on earnings up to the Social Security wage base ($176,100 in 2025, subject to change).

- 2.9% (Medicare) on all earnings above that limit, plus an additional 0.9% Medicare surtax on income over $200,000 (Single filers).

- The S Corp allows you to exempt a large portion of that $500,000 profit from the 15.3% and 2.9% Medicare tax.

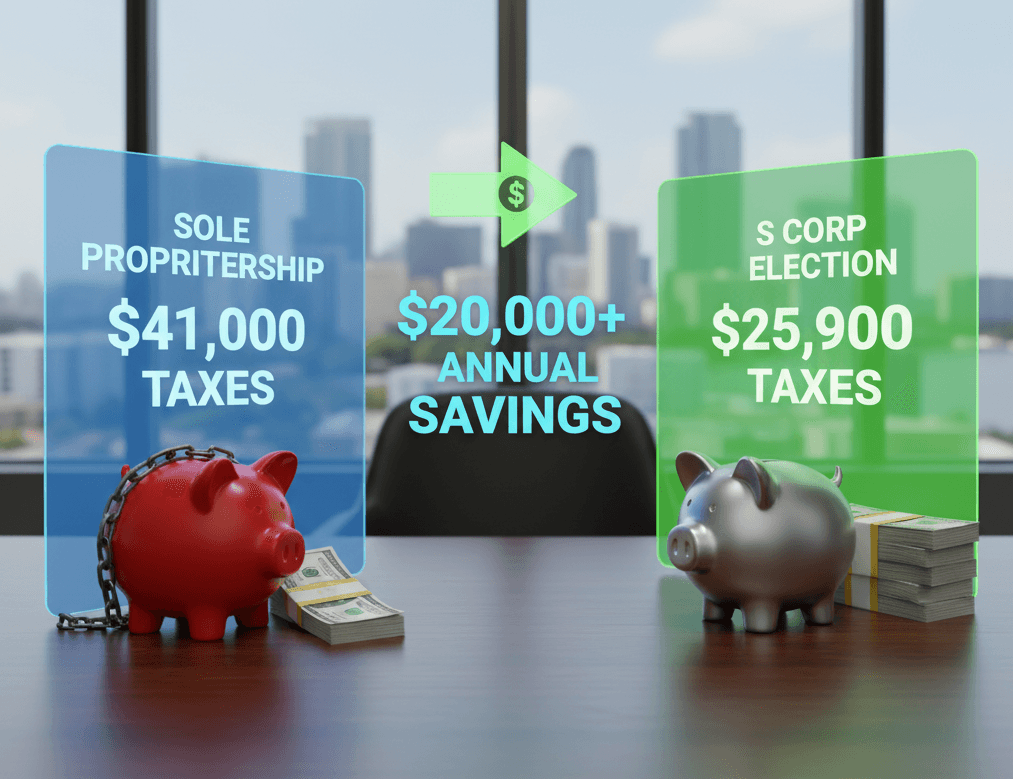

Worked Example: Over $20,000 in Annual Tax Savings

Let's model the tax impact for a high-profit Davie service business with a $500,000 net profit, comparing the Sole Proprietorship default versus a properly structured S Corp.

For this income level, a reasonable salary for a professional service owner is likely around 30% to 40% of the profit. We'll use $170,000 as a strong, defensible salary, which covers the Social Security wage base and accounts for the owner's active management role.

Scenario Comparison: High-Profit Service Business

Sole Proprietorship (Schedule C LLC)

Total Net Business Income: $500,000

Income Subject to FULL FICA (15.3%): ≈$176,100

Income Subject to Medicare Only (2.9%+): ≈$323,900

Estimated Employment Tax Due (FICA/SE Tax): ≈$41,000

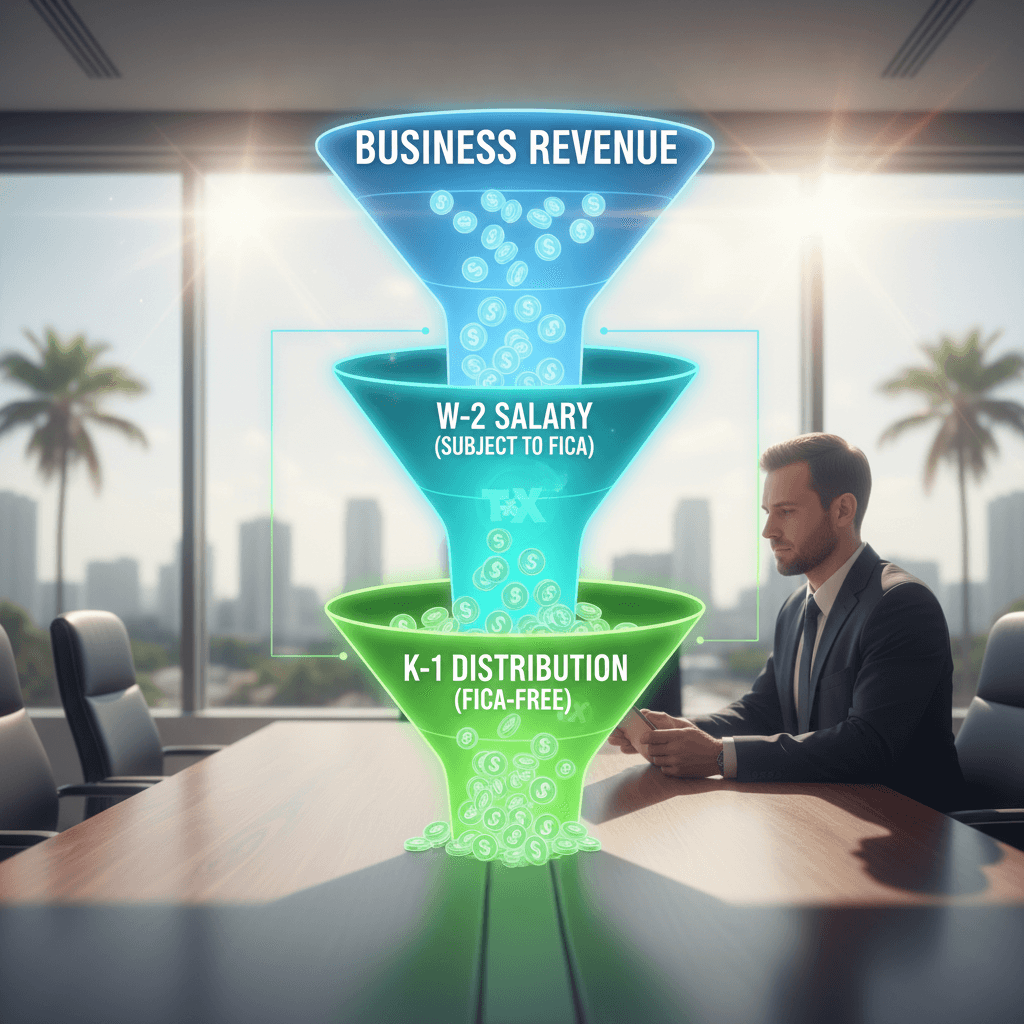

S Corporation (LLC Taxed as S Corp)

Total Net Business Income: $500,000

Owner's Reasonable Salary (W-2): $170,000

Owner's Tax Distribution (K-1): $330,000

Income Subject to FULL FICA (15.3%): $170,000 (W-2 Portion)

Income Subject to Medicare Only (2.9%+): $330,000 (K-1 Distribution +$0 FICA)

Estimated Employment Tax Due (FICA/SE Tax): ≈$25,900

Estimated Annual Employment Tax Savings: ≈$15,100 Additional Savings (Medicare Surtax + QBI): ≈$5,000 to $10,000 TOTAL Annual Tax Savings: $20,000+

How the S Corp Saves: In the S Corp, the $330,000 distribution is exempt from the 2.9% Medicare tax and the 0.9% Medicare surtax, saving roughly 3.8% on that large segment of income.

Crucial Caveat: It's NOT One-Size-Fits-All 🛑

While the S Corp is the ideal choice for most high-profit service businesses, it is not a universal solution. At Benefique, we stress that each situation is different.

When an S Corp May Be The WRONG Choice

Holding Passive Real Estate: Investment property should usually be held in a separate LLC taxed as a Partnership to utilize tax-free transfers and maximized depreciation benefits.

Future Equity Funding/Complex Ownership: If you plan to issue multiple classes of stock, bring in venture capital, or have non-resident alien shareholders, a C Corporation might be more suitable.

High Income/Profit Retention Focus: If your goal is to retain significant profit within the business for reinvestment, and you are willing to pay the Florida Corporate Income Tax (5.5%) and federal 21% corporate tax rate on retained earnings, consider a C Corporation.

High-Risk/Liability Operations: In some cases, a Multi-Entity Structure (e.g., Parent/Subsidiary LLCs) with an LLC holding assets leased to the S Corp operating business provides layered asset protection.

The key takeaway: An S Corp is optimized for an active, owner-operated business focused on minimizing SE Tax and maximizing QBI deduction on operating income. Its tax flexibility is limited outside of these two areas.

4-Step Framework: The High-Profit Entity Blueprint

Step 1: Determine and Defend Reasonable Compensation

Goal: Establish the lowest defensible W-2 salary ($170,000 in our example) to minimize the FICA tax base.

The IRS Test: We use comparable data for your role and industry in the South Florida market. Paying yourself only $50,000 on $500,000 profit is an audit trigger.

Benefique Process: We document the justification based on industry salary surveys, local economics, and your specific duties to withstand IRS scrutiny.

Step 2: Formalize the Legal & Tax Status

Goal: Ensure your legal liability is bulletproof and the election is timely.

Asset Protection: Ensure your LLC is current with the Florida Department of State and operating agreement is in place. This legal shield is paramount.

File Form 2553: File the S Corp election with the IRS. The March 15th deadline for the current tax year is inflexible and critical. Don't miss it.

Step 3: Implement Compliant Payroll & Accounting

Goal: Set up robust systems that meet the higher S Corp compliance standard.

Payroll Protocol: Your W-2 salary must be run through a compliant payroll system (Form 941 quarterly, W-2 year-end). The business pays the employer share of FICA, and the employee share is withheld.

Audit Defense: The requirement to file a corporate return (Form 1120-S) forces proper segregation of business and personal finances, significantly lowering your audit risk compared to a high-profit Schedule C.

Step 4: Unlock Wealth-Building Strategies

Goal: Leverage the S Corp structure for permanent tax reduction beyond SE Tax.

QBI Deduction: The S Corp W-2 wages are critical for maximizing the 20% Qualified Business Income (QBI) Deduction—a massive federal break on your pass-through income.

Tax-Free Benefits: You can now deduct 100% of your health insurance premiums and fully fund advanced retirement vehicles like a Solo 401(k) or Defined Benefit Plan, utilizing both your W-2 and K-1 income streams.

Tax-Free Benefits: You can now deduct 100% of your health insurance premiums and fully fund advanced retirement vehicles like a Solo 401(k) or Defined Benefit Plan, utilizing both your W-2 and K-1 income streams.

Common Mistakes for High-Profit SMBs

Underpaying Reasonable Salary: The IRS can reclassify your entire distribution ($330,000) as salary, hitting you with tens of thousands in back FICA tax, interest, and penalties. Benefique's

Solution: We help establish a defensible W-2 salary that reflects the market value of your services in Broward County, typically 30% to 40% of net profit.

Co-mingling Funds: Treating the business bank account like your personal account compromises the LLC's asset protection shield (losing the legal benefit of the LLC). Benefique's Solution: Strictly separate personal and business expenses. Use a personal account for personal, and business for business. Maintain formal resolutions for owner distributions.

Ignoring Corporate Income Tax: If you accidentally structure as a C Corp, your $500,000 profit is taxed at the federal 21% corporate rate, plus Florida's 5.5% corporate tax on any profit apportioned to the state. Benefique's Solution: We confirm and file the S Corp election (pass-through status) to ensure income is only taxed at the individual level (Form 1040).

Local Proof & Trust

Florida-Specific Tax Note: The absence of a state personal income tax makes the federal-level S Corporation tax savings (on FICA/SE tax) even more impactful for Florida SMBs. Unlike owners in high-tax states, you're not paying a significant state tax on your K-1 distributions, allowing the full federal savings to be realized in your pocket. However, C Corporations operating in Florida are subject to the Florida Corporate Income Tax (currently 5.5%, with exemptions), which is a key consideration if you choose that entity type.

The Benefique Tax & Accounting team leverages its experience serving high-touch professional service and trade clients across Davie and the broader Broward County region to provide specific, data-driven advice on entity optimization.

Frequently Asked Questions (FAQ)

Q1. Can an existing LLC in Davie, FL, switch to S Corporation tax status?

Yes. An LLC can elect S Corporation tax status at any time by filing IRS Form 2553. For the election to be effective for the current tax year, it must typically be filed by March 15th.

Q2. What is "reasonable compensation" for a Broward County business owner?

Reasonable compensation is the amount a non-owner employee would be paid for the same duties and responsibilities in your industry and geographic area (Broward County). Failing to pay a reasonable W-2 salary is the biggest S Corporation tax mistake and will trigger IRS penalties.

Q3. Does S Corp status affect the QBI Deduction (Section 199A)?

S Corp status often makes it easier to maximize the Qualified Business Income (QBI) Deduction (up to 20% of qualified business income). For service businesses, the W-2 salary paid through the S Corp can be used to meet the wage limitations required to take the full QBI deduction.

Q4. Does the S Corp help with asset protection in Florida?

The LLC provides the asset protection shield against business liabilities. The S Corp is simply a tax election on top of the LLC. You get the best of both worlds: protection from the LLC and tax savings from the S Corp election.