IRS Enforcement Alert: What Davie Business Owners Need to Know in 2025

GD

As a business owner in Davie, Florida, you've built something meaningful. Whether you're running a medical practice, a construction company, a tech startup, or a professional services firm, you've invested countless hours into making your business successful. But there's a shift happening at the IRS that every South Florida business owner needs to understand—and it's happening right now.

The Reality: IRS Audits Are Increasing

After years of declining audit rates and reduced enforcement capacity, the IRS is back—and they're focused. Thanks to funding from the Inflation Reduction Act, the agency has rebuilt its enforcement capabilities and is systematically targeting specific taxpayer groups.

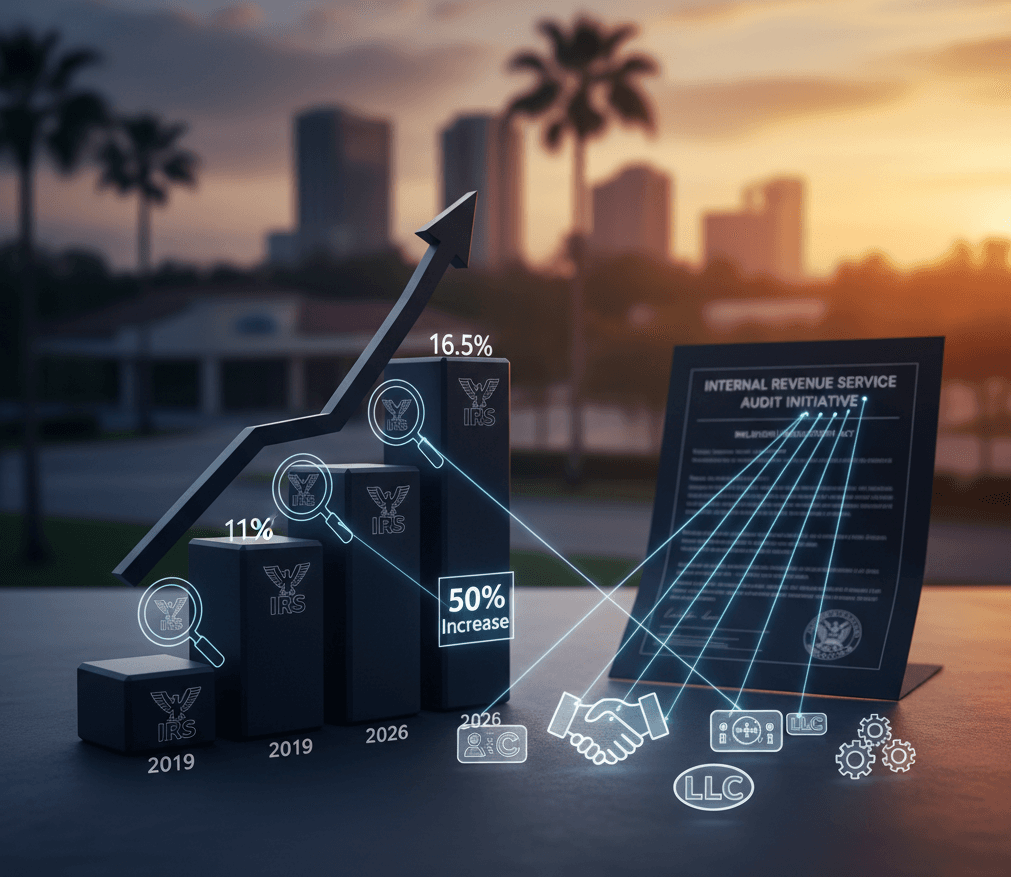

The numbers tell the story. The IRS increased audits of high-income taxpayers during fiscal year 2024, planning to examine 70,812 returns for taxpayers earning above $400,000. For those earning more than $10 million, the audit rate is expected to jump by 50%, rising from 11% in 2019 to 16.5% by 2026. Large corporations with assets over $250 million will see audit rates triple.

If you're thinking "I'm not a multi-millionaire, so I'm safe"—not so fast. The IRS is also significantly ramping up audits of business partnerships and pass-through entities, which describes the vast majority of small and medium-sized businesses in Davie.

Which Tax Years Are Under the Microscope?

The IRS typically has three years to audit a tax return, which means they're currently focusing on tax years 2021, 2022, and 2023. However, they're also working through older cases from 2017-2021 for high-income taxpayers as part of their enhanced enforcement efforts.

If you filed returns during these years and there were any gray areas, aggressive positions, or less-than-perfect documentation, you could be hearing from the IRS soon.

High-Risk Areas for Davie Business Owners

1. Partnership and Pass-Through Entity Scrutiny

Most Florida businesses operate as LLCs, S-corporations, or partnerships. These entities have historically had very low audit rates, but that's changing dramatically. The IRS knows that partnership structures have grown increasingly complex, and they're dedicating significant resources to examining these returns.

What to watch: Basis calculations, distributions, guaranteed payments, and related-party transactions are all under heightened scrutiny.

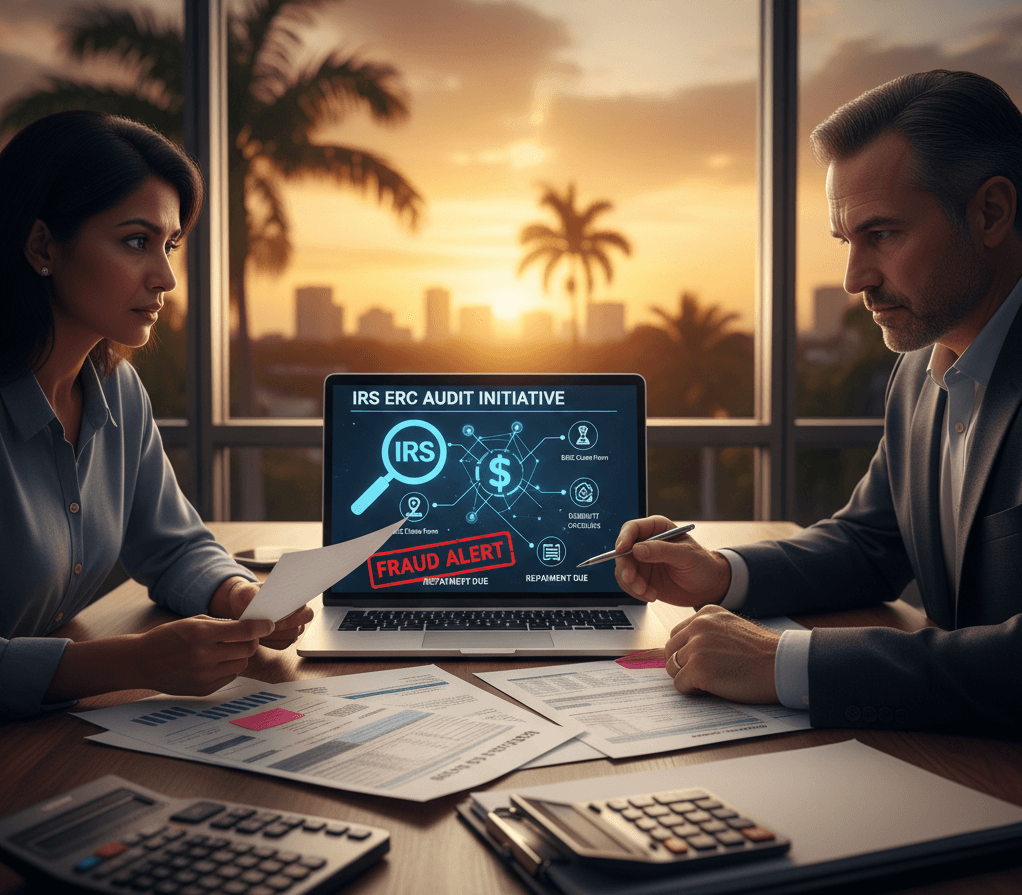

2. Employee Retention Credit (ERC) Claims

Many Davie businesses claimed ERC during the pandemic, and some worked with aggressive promoters who promised easy money. The IRS is now pursuing improper ERC claims aggressively, demanding repayment with substantial penalties and interest.

The risk: If you claimed ERC and aren't 100% certain you qualified, you need to address this proactively before the IRS comes knocking.

3. Cryptocurrency and Digital Assets

South Florida has a vibrant crypto community, and many business owners have invested in or accepted digital assets. The IRS has made crypto compliance a priority, and they're matching transaction data from exchanges against tax returns.

The exposure: Unreported crypto sales, staking rewards, NFT transactions, or mining income can trigger audits and penalties.

4. Home Office and Vehicle Deductions

With remote work becoming standard, many business owners have taken home office deductions. The IRS is scrutinizing these claims more carefully, particularly for businesses claiming 100% business use of vehicles or large home office deductions without proper documentation.

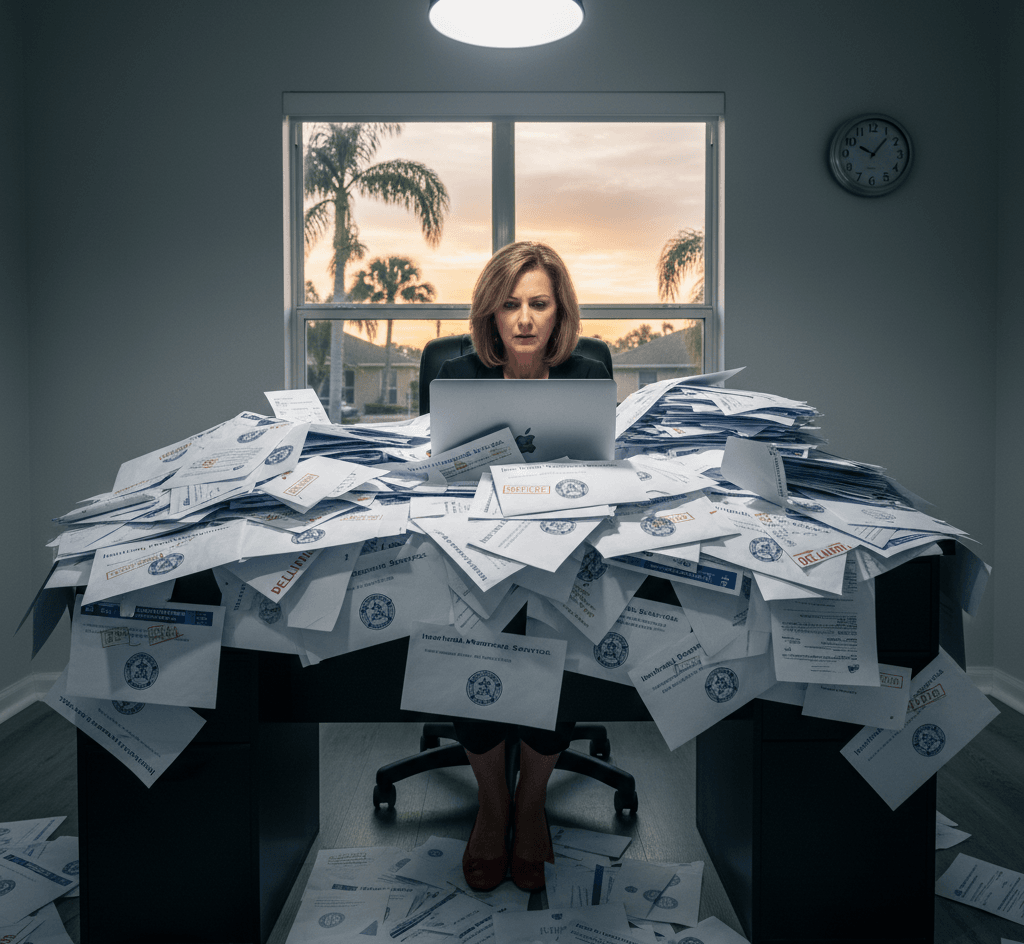

The Notice Tsunami

Beyond audits, the IRS sends approximately 150 million notices to taxpayers annually. Many Davie business owners have already noticed an uptick in correspondence from the IRS. These notices range from simple math error corrections to more serious audit notifications and collection demands.

The problem? Ignoring or mishandling these notices can quickly escalate into serious problems with penalties, interest, and enforcement actions like liens or levies.

Why Reactive Planning No Longer Works

For years, many business owners took a reactive approach to taxes: file the return, hope for the best, and deal with issues if they arise. That strategy is increasingly dangerous in today's enforcement environment.

The IRS has more resources, better technology, and a clear mandate to pursue high-income taxpayers and complex business structures. By the time you receive an audit notice, your options are limited and your costs are higher.

The Proactive Alternative

Smart business owners in Davie are shifting to proactive tax compliance. This means:

Regular Compliance Reviews: Examining prior-year returns for potential issues before the IRS does, allowing you to address problems through voluntary disclosure or amended returns when appropriate.

Documentation Systems: Implementing processes to maintain contemporaneous records for deductions, business expenses, and transactions—the kind of documentation that withstands audit scrutiny.

Strategic Planning: Making tax decisions throughout the year, not just at year-end, to ensure compliance while maximizing legitimate tax benefits.

Partnership Agreement Reviews: Ensuring your operating agreements, K-1 allocations, and basis tracking are properly structured and documented.

ERC Claim Verification: If you claimed ERC, having an independent review to verify eligibility and calculate exposure if the IRS challenges your claim.

Crypto Compliance: Properly reporting all digital asset transactions and implementing systems to track basis and gains accurately.

The Bottom Line for Davie Business Owners

The IRS enforcement environment has fundamentally changed. The days of flying under the radar with aggressive positions or incomplete documentation are over. The audit rates are rising, the technology is improving, and the stakes are higher.

But here's the good news: with proactive planning, proper documentation, and strategic compliance, you can significantly reduce your audit risk and be prepared if the IRS does come calling.

Your business deserves more than reactive crisis management when an audit notice arrives. It deserves a proactive strategy that protects what you've built while ensuring compliance with an increasingly aggressive IRS.

The question isn't whether the IRS will increase enforcement—they already are. The question is whether you'll be prepared when they do.

At Benefique, we help Davie business owners navigate the complex tax landscape with proactive solutions that reduce risk and provide peace of mind. Don't wait for an audit notice to take action. Contact us today to schedule a compliance review and ensure your business is protected in this new enforcement environment.